Telecom Power Systems Industry

Summary:

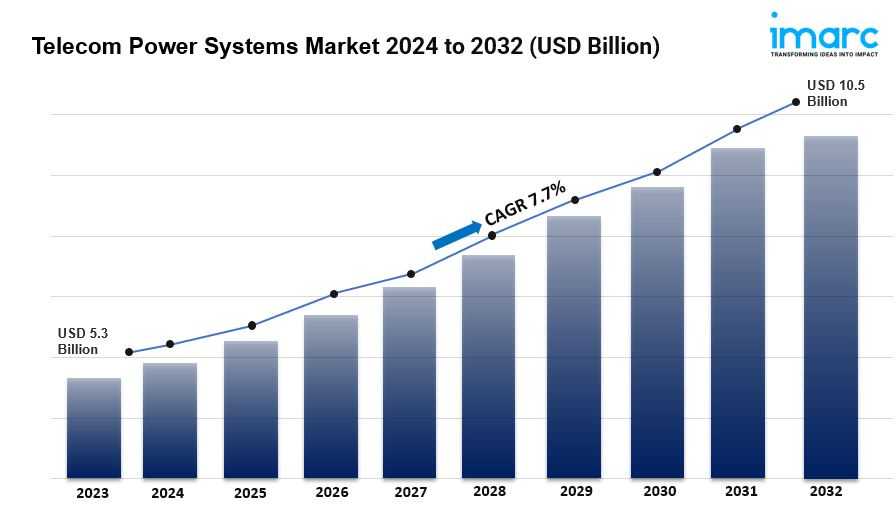

- The global telecom power systems market size reached US$ 5.3 Billion in 2023.

- The market is expected to reach US$ 10.5 Billion by 2032, exhibiting a growth rate (CAGR) of 7.7% during 2024-2032.

- North America leads the market, accounting for the largest telecom power systems market share due to its advanced telecom infrastructure.

- DC accounts for the majority of the market share in the product type segment due to their efficiency in powering telecom equipment directly.

- Generators holds the largest share in the telecom power systems industry as they are crucial for backup power.

- Diesel-battery remain a dominant segment in the market owing to their reliability and ability to provide continuous power.

- Bad grid represents the leading application segment due to frequent electricity instability.

- The rising data consumption across the globe is a primary driver of the telecom power systems market.

- Rapid expansion of 5G networks and ongoing remote installations are reshaping the telecom power systems market.

Industry Trends and Drivers:

- Growing Data Consumption:

The surge in mobile device usage, internet connectivity, and cloud-based applications is one of the primary drivers of the telecom power systems market. With billions of users worldwide relying on mobile networks for communication, entertainment, and business operations, telecom companies are under increasing pressure to ensure that their networks can handle high data traffic without disruption. The proliferation of streaming services, video conferencing platforms, and the growing adoption of smart devices contribute significantly to this data load. As telecom infrastructure becomes more complex and interconnected, there is a corresponding increase in the demand for robust, reliable power systems that can ensure uninterrupted service. Power outages or fluctuations can lead to downtime, affecting customer satisfaction and business continuity.

- Expansion of 5G Networks:

The deployment of fifth-generation (5G) networks represents a significant shift in telecommunications, bringing faster speeds, lower latency, and greater connectivity potential. However, 5G networks are far more energy-intensive compared to previous generations like fourth-generation (4G) and third-generation (3G). The need for higher bandwidth, massive data processing, and real-time communication has led to an increased demand for more advanced telecom power systems. Unlike earlier network generations, 5G requires a dense network of small cells and base stations to deliver consistent coverage, further increasing the energy consumption per unit of data transmitted. This is especially true in densely populated urban areas, where maintaining network reliability is crucial. Telecom operators are now focusing on deploying energy-efficient power solutions to meet the power demands of 5G infrastructure while minimizing operational costs.

- Remote and Off-Grid Installations:

As telecom companies extend their services to rural, remote, and underserved areas, the demand for reliable power systems in off-grid locations is becoming increasingly critical. In many parts of the world, these remote regions do not have access to a stable electricity grid, making it essential for telecom operators to implement alternative power solutions to ensure network functionality. Hybrid power systems, which combine renewable energy sources like solar or wind with battery storage, have emerged as a key solution for these locations. Such systems offer greater autonomy and reduce reliance on diesel generators, which are both costly and environmentally damaging. The need to minimize downtime and maintain consistent connectivity in these areas drives the adoption of telecom power systems that can operate efficiently in harsh or isolated environments.

Request for a sample copy of this report: https://www.imarcgroup.com/telecom-power-systems-market/requestsample

Telecom Power Systems Market Report Segmentation:

Breakup By Product Type:

- DC

- AC

DC account for the majority of shares due to their efficiency in powering telecom equipment directly, reducing energy loss compared to AC systems.

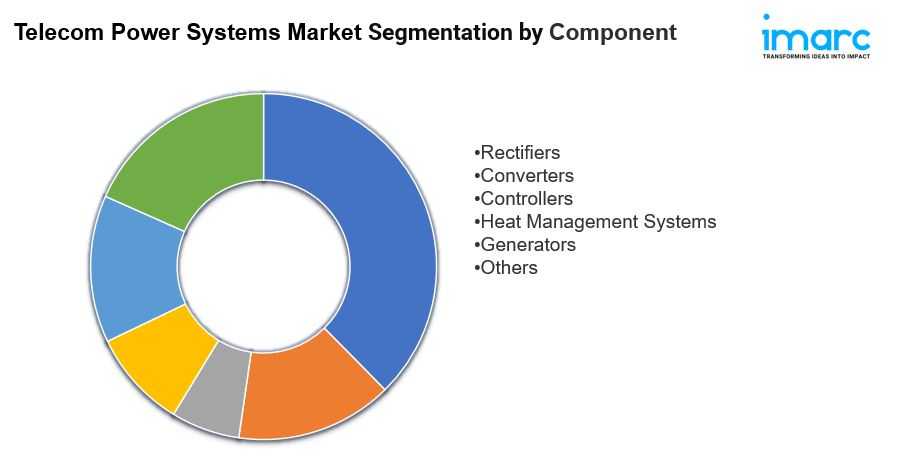

Breakup By Component:

- Rectifiers

- Converters

- Controllers

- Heat Management Systems

- Generators

- Others

Generators dominates the market as they are crucial for backup power in areas prone to outages, ensuring uninterrupted telecom operations.

Breakup By Power Source:

- Diesel-Battery

- Diesel-Solar

- Diesel-Wind

- Multiple Sources

Diesel-battery represents the majority of shares owing to their reliability and ability to provide continuous power in remote or off-grid locations.

Breakup By Grid Type:

- On Grid

- Off Grid

- Bad Grid

Bad grid hold the majority of shares due to frequent electricity instability, driving demand for power solutions in such areas.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America holds the leading position owing to its advanced telecom infrastructure and high investment in 5G and renewable energy-powered systems.

Top Telecom Power Systems Market Leaders:

The telecom power systems market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Delta Electronics Inc.

- Eaton Corporation plc

- ABB Ltd.

- Huawei Technologies Co. Ltd.

- Schneider Electric SE

- Vertiv Group Corporation

- Cummins Inc.

- Myers Power Products Inc.

- Ascot Industrial S.r.l.

- Unipower

Browse full report with TOC List of Figures: https://www.imarcgroup.com/request?type=reportid=1107flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145