A real estate investment analyst plays a critical role in the success of real estate deals and investment opportunities. These professionals are responsible for evaluating properties, conducting financial analysis, and providing insightful recommendations to help investors make informed decisions. To excel in this field, analysts must possess a wide range of skills that allow them to navigate the complexities of the real estate market. From financial modeling to communication, the right skill set can transform an average analyst into a highly sought-after expert.

In this blog, we’ll explore the essential skills every real estate investment analyst needs to succeed. Whether you're just starting your career or looking to sharpen your abilities, these skills will help you stand out in a competitive industry.

1. Financial Analysis and Modeling

At the core of a real estate investment analyst’s responsibilities is the ability to perform detailed financial analysis. Understanding the financial performance of properties and being able to model various investment scenarios is critical to making sound investment decisions.

Mastering Cash Flow and ROI Calculations

One of the most important aspects of financial analysis is understanding cash flow—how much income a property generates versus its operating expenses. Additionally, analysts need to calculate the return on investment (ROI) to determine whether a property will meet the investor’s financial goals. This involves estimating future revenues, expenses, and potential risks.

Building Financial Models

A skilled real estate investment analyst should be proficient in building complex financial models. Tools like Excel, ARGUS, and other modeling software are commonly used to simulate various scenarios and forecast how different factors—such as interest rates or vacancy rates—will affect an investment. These models help provide a clear picture of potential outcomes, which is crucial for making well-informed investment decisions.

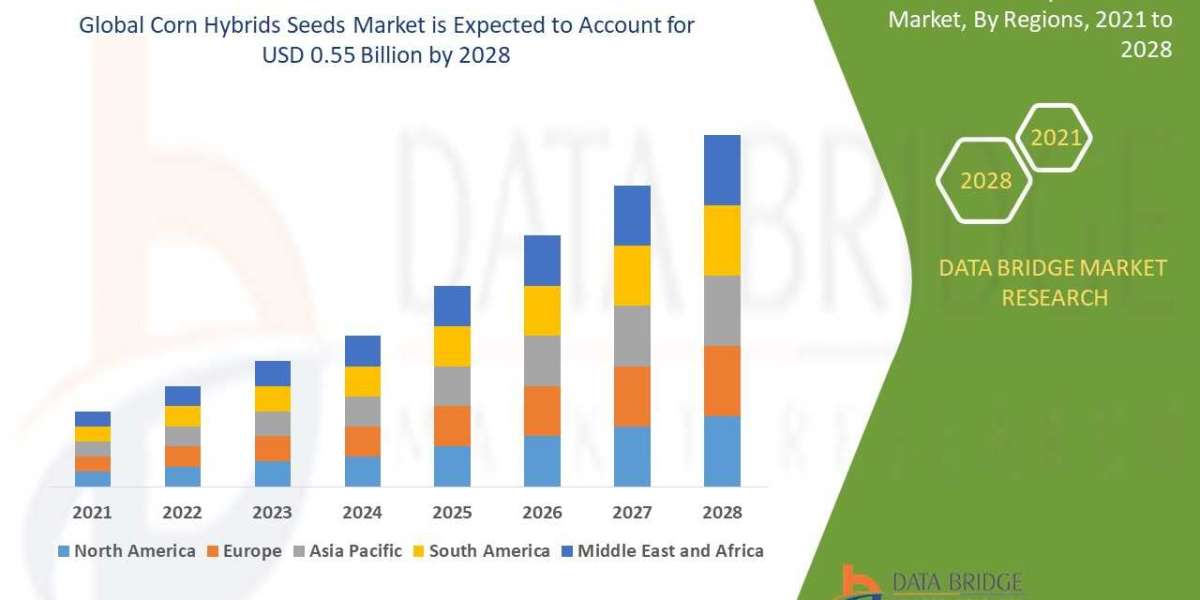

2. Market Research and Data Analysis

Another essential skill for any real estate investment analyst is the ability to conduct thorough market research. Understanding local market trends, property values, and economic factors that can influence real estate investments is key to making informed recommendations.

Identifying Market Trends

Successful analysts must stay on top of the latest trends in the real estate market, including changes in property values, interest rates, and demand for specific property types. This involves using tools like CoStar or MLS databases to gather current data on market conditions. Recognizing these trends early on allows analysts to position their clients for success by identifying lucrative investment opportunities.

Interpreting Economic Indicators

Beyond understanding the real estate market itself, analysts must also be able to interpret broader economic indicators such as GDP growth, unemployment rates, and consumer confidence. These factors can significantly impact the real estate market, affecting property prices and investor demand. By staying informed on economic trends, analysts can help clients make decisions that align with the overall health of the economy.

3. Critical Thinking and Problem-Solving

The real estate market is unpredictable, and a real estate investment analyst must be able to think critically and solve problems efficiently. From unexpected market shifts to unforeseen expenses, challenges can arise at any point in the investment process.

Analyzing Risk

A key aspect of problem-solving is the ability to assess and mitigate risk. Real estate investments come with inherent risks, such as fluctuating property values, changes in interest rates, or tenant defaults. Analysts must evaluate these risks and develop strategies to minimize them. This may involve diversifying a portfolio, negotiating better financing terms, or reevaluating a property’s potential before making an investment.

Creative Solutions to Investment Challenges

Not every deal is straightforward, and sometimes analysts need to think creatively to find solutions to challenges. This could involve restructuring a deal, finding alternative financing options, or negotiating better terms with sellers. The ability to think outside the box and approach problems with a fresh perspective is invaluable for any real estate investment analyst looking to maximize returns.

4. Communication and Presentation Skills

While crunching numbers and analyzing data is essential, being able to effectively communicate your findings is equally important. A real estate investment analyst must be able to present complex financial information in a clear and concise manner.

Simplifying Complex Data

Not all investors have a financial background, so analysts must be able to simplify complex financial models and present data in an understandable way. This involves breaking down key metrics, explaining the assumptions behind models, and highlighting the most important findings. Tools like PowerPoint and Tableau can be used to create visual representations of data, making it easier to convey insights to clients.

Persuasive Communication

In addition to simplifying data, analysts also need strong persuasive communication skills. Whether it’s pitching a new investment opportunity to a client or presenting a risk assessment to a team of investors, the ability to persuade others with data-driven insights is crucial. Clear communication builds trust and helps clients feel confident in the decisions they’re making based on the analyst’s recommendations.

5. Attention to Detail

One small error in a financial model or misinterpretation of market data can have significant consequences for an investment. That’s why attention to detail is a must for any real estate investment analyst.

Reviewing Financial Models

Analysts often work with large datasets and complex financial models, where even a small mistake can lead to inaccurate conclusions. A meticulous review process helps ensure that every assumption, calculation, and formula is correct. This attention to detail is essential for providing clients with reliable and accurate investment advice.

Spotting Hidden Opportunities

Attention to detail is not only important for avoiding mistakes—it also helps analysts spot hidden opportunities. For example, an overlooked factor such as a pending zoning change or infrastructure development could significantly increase a property’s value in the future. A careful, detail-oriented analyst can identify these opportunities and recommend investments that others might miss.

6. Technology Proficiency

In today’s digital age, technology plays a crucial role in real estate investment analysis. Proficiency with financial modeling software, market research platforms, and data visualization tools is a must for any modern real estate investment analyst.

Leveraging Software Tools

From ARGUS for financial modeling to CoStar for market research, there are numerous software tools available that can enhance an analyst’s ability to evaluate properties and market conditions. Analysts who can quickly adapt to and utilize these technologies are better equipped to provide comprehensive, data-driven insights for their clients.

Adapting to Emerging Technologies

As new technologies like artificial intelligence (AI) and machine learning continue to evolve, real estate investment analysts will need to stay on top of these developments. These technologies are already beginning to automate some aspects of market analysis and financial modeling, enabling analysts to focus on higher-level strategic decision-making. Those who can effectively leverage emerging technologies will have a significant advantage in the field.

Conclusion: Building a Successful Career as a Real Estate Investment Analyst

Being a successful real estate investment analyst requires more than just understanding the real estate market. It’s about developing a comprehensive skill set that includes financial analysis, market research, communication, and technology proficiency. With the right combination of skills, analysts can provide clients with invaluable insights and help them make informed, data-driven investment decisions.

By mastering these essential skills, you’ll be well-equipped to excel in this dynamic and competitive field, helping investors achieve their goals and maximizing returns on real estate investments.