The galvanized sheet market plays a critical role in multiple industries, ranging from construction and automotive to energy and infrastructure. Monitoring the Galvanized Sheet Price Trend is essential for businesses and stakeholders who rely on steel materials that offer durability and corrosion resistance. This press release provides an in-depth overview of the galvanized sheet price trend, including detailed analysis, news updates, price index, charts, and graphs to help industry participants make well-informed decisions.

Request Free Sample – https://www.procurementresource.com/resource-center/galvanized-sheet-price-trends/pricerequest

Galvanized Sheet Price Trend

The Galvanized Sheet Price Trend has experienced fluctuations over the past decade due to changes in global demand, raw material costs, and supply chain disruptions. Galvanized sheets, which are steel sheets coated with a layer of zinc to prevent rusting, are in high demand across various sectors. As such, the price of galvanized sheets is closely tied to market conditions and the health of industries such as construction, automotive, and energy.

In recent years, galvanized sheet prices have been on an upward trajectory, especially since 2020, when the COVID-19 pandemic disrupted supply chains, caused labor shortages, and increased production costs. This led to a supply-demand imbalance, resulting in higher prices. The trend continued in 2021 and 2022 as industries recovered, particularly with a surge in construction and infrastructure projects.

However, price fluctuations in 2023 have been more moderate as global supply chains stabilize. Despite this, demand for galvanized sheets remains strong, and prices are expected to rise steadily due to the increased need for corrosion-resistant materials in construction and automotive industries.

Key factors influencing the Galvanized Sheet Price Trend include:

Global Steel Production: Galvanized sheets are made from steel, and thus, their prices are directly linked to the global steel market. Any changes in steel production, such as raw material shortages or increased energy costs, can lead to price fluctuations for galvanized sheets.

Raw Material Costs: Zinc is a key component in the galvanization process, and the price of zinc has seen considerable volatility due to mining output, environmental regulations, and global trade policies. Any fluctuations in zinc prices affect the cost of producing galvanized sheets.

Supply Chain Disruptions: The global steel market has been significantly impacted by logistical challenges, such as shipping delays and transportation costs. These disruptions have created supply shortages, further driving up prices.

Demand from Key Industries: The demand for galvanized sheets is heavily influenced by industries like automotive and construction, which rely on these materials for their durability and resistance to corrosion. As these industries expand, particularly in developing countries, the demand for galvanized sheets is expected to rise, further influencing price trends.

Galvanized Sheet Price Analysis

Conducting a thorough Galvanized Sheet Price Analysis is essential for understanding the market dynamics and anticipating future trends. Prices are influenced by several key factors, such as production costs, global demand, and geopolitical influences, which all play a role in determining the overall market behavior.

Production Costs: The cost of producing galvanized sheets depends heavily on the price of raw materials such as steel and zinc. As steel prices fluctuate due to changing demand and supply conditions, galvanized sheet prices also experience volatility. Additionally, energy costs, which are a major input for steel production, have been rising, adding further pressure on production costs.

Geopolitical Factors: Trade restrictions, tariffs, and other geopolitical factors can have a significant impact on the galvanized sheet market. For example, tariffs on steel imports in major economies like the U.S. and Europe have caused shifts in supply chains, leading to localized price increases.

Environmental Regulations: The push toward greener manufacturing processes has increased operational costs for steel producers, especially with regulations aimed at reducing carbon emissions. These additional costs are often passed on to consumers, leading to higher prices for galvanized sheets.

Market Demand: The demand for galvanized sheets has been particularly strong in sectors such as infrastructure and renewable energy. As governments worldwide invest in infrastructure development and green energy projects, the demand for galvanized steel, including galvanized sheets, is projected to increase, leading to higher prices.

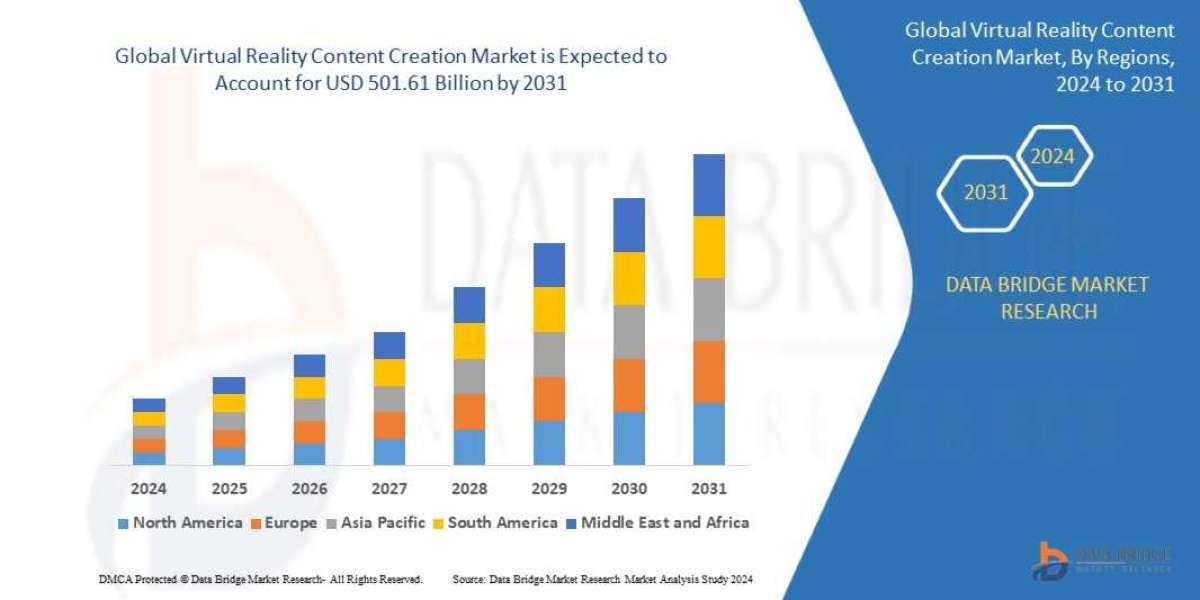

Galvanized Sheet Price Chart

A Galvanized Sheet Price Chart provides a visual representation of price movements over time. Examining historical data can offer insights into market trends and help stakeholders predict future price behavior. A typical price chart for galvanized sheets would display fluctuations over the past several years, with notable peaks and troughs corresponding to market disruptions or periods of high demand.

For example, a Galvanized Sheet Price Chart for the period between 2015 and 2023 would reveal several key trends:

- In 2016, prices were relatively stable due to consistent steel production and modest demand.

- By 2018, prices began to rise significantly as global demand for steel surged, driven by a construction boom in several economies.

- The onset of the COVID-19 pandemic in 2020 caused a steep decline in production, followed by a rapid increase in prices as demand rebounded in 2021 and 2022.

- Prices in 2023 have seen moderate stabilization as supply chains recovered, though rising raw material costs and high energy prices continue to impact the market.

Analyzing this data helps manufacturers, contractors, and buyers understand the cyclical nature of galvanized sheet prices, allowing them to make more informed procurement and investment decisions.

Galvanized Sheet Price News

Keeping up with the latest Galvanized Sheet Price News is essential for businesses operating in industries that rely on steel products. Various factors contribute to changes in galvanized sheet prices, and staying informed about these developments can help stakeholders anticipate market shifts.

Some recent Galvanized Sheet Price News includes:

Increased Demand from Renewable Energy Projects: Governments worldwide are focusing on renewable energy and infrastructure projects, which has resulted in increased demand for galvanized steel, particularly in the solar and wind energy sectors. As a result, prices for galvanized sheets have risen, especially in regions where renewable energy projects are a priority.

Supply Chain Stabilization Post-COVID: After two years of significant disruptions due to the pandemic, global supply chains are gradually returning to normal. However, logistical challenges such as rising fuel costs and shipping delays continue to affect the galvanized sheet market, leading to short-term price fluctuations.

Zinc Price Volatility: The price of zinc, which is crucial for galvanizing steel, has been highly volatile due to mining disruptions and environmental regulations. Recent news reports indicate that zinc prices are expected to remain elevated, putting upward pressure on galvanized sheet prices.

Trade Policies and Tariffs: Trade policies, particularly between the U.S. and China, have continued to impact global steel markets. Any changes in tariffs or trade restrictions could affect galvanized sheet prices by altering the flow of steel products across borders.

By staying up-to-date with Galvanized Sheet Price News, businesses can better prepare for price fluctuations and adjust their purchasing strategies accordingly.

Galvanized Sheet Price Index

The Galvanized Sheet Price Index tracks the average price changes over time, providing stakeholders with a benchmark for understanding market trends. This index takes into account global prices from various sources and regions, offering an accurate snapshot of the galvanized sheet market’s performance.

In 2023, the Galvanized Sheet Price Index has shown a moderate increase, reflecting the overall rise in steel prices and the growing demand for galvanized products. The index is particularly useful for manufacturers and contractors who need to compare their purchase prices against market averages, ensuring they are making cost-effective decisions.

The Galvanized Sheet Price Index is also a valuable tool for forecasting future price movements. By analyzing changes in the index over time, stakeholders can identify trends such as rising production costs, demand spikes, or supply shortages, all of which can inform their procurement strategies and financial planning.

Galvanized Sheet Price Graph

A Galvanized Sheet Price Graph provides a visual summary of how prices have changed over a specific period. These graphs are useful for identifying patterns, such as seasonal fluctuations or long-term trends, that might not be immediately obvious from numerical data alone.

For example, a Galvanized Sheet Price Graph for 2023 might show a gradual increase in prices during the first half of the year, driven by higher raw material costs and strong demand from the construction sector. The graph could then reveal a slight price dip during the summer months as supply chains stabilize, followed by another rise in prices toward the end of the year due to increased demand from infrastructure projects.

By analyzing price graphs, stakeholders can gain a clearer understanding of when prices are likely to be at their highest or lowest points, allowing them to time their purchases and maximize cost savings.

About Us:

Procurement Resource is an invaluable partner for businesses seeking comprehensive market research and strategic insights across a spectrum of industries. With a repository of over 500 chemicals, commodities, and utilities, updated regularly, they offer a cost-effective solution for diverse procurement needs. Their team of seasoned analysts conducts thorough research, delivering clients with up-to-date market reports, cost models, price analysis, and category insights.

By tracking prices and production costs across various goods and commodities, Procurement Resource ensures clients receive the latest and most reliable data. Collaborating with procurement teams across industries, they provide real-time facts and pioneering practices to streamline procurement processes and enable informed decision-making. Procurement Resource empowers clients to navigate complex supply chains, understand industry trends, and develop strategies for sustainable growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Amanda Williams

Email: sales@procurementresource.com

Toll-Free Number: USA Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA